portability real estate taxes florida

Will be applied to the assessed value of the new homesteaded property in the year that the portability. If you moved to Hillsborough County from another Florida County provide the most complete address you can and be sure to.

An example of the 2 year window is if you are applying for homestead for 2020 you must have had.

. Property Tax Portability Florida Election Results are In Real Estate a Big Winner. Property Tax Rules Published as of September 2017 Provided by the Florida Department of Revenue Property Tax Oversight PT -111112 R. What is the Florida property tax or real estate tax.

Having trouble viewing our website. By way of background the homestead tax benefit in Florida has two primary aspects which are. Savings of 3000 to 4000 per year.

The average property tax rate in Florida is 083. The law allows up to 2 years for transfer of the portability benefit. 1 12021 Chapters 12D-1 to 12D-51 Florida.

Given that Florida has around a 2 average tax rate that means a homeowner with. When buying real estate property do not assume property taxes will remain the same. Florida property owners have to pay property taxes each year based on the value of their property.

So just what is Florida Property Tax Portability. The maximum portability benefit that can be transferred is 500000. Florida property owners can receive a 25000 property tax exemption for their.

Wow what a day for Property Tax Portability and property owners in. The law allows up to 2 years for transfer of the portability benefit. This savings will remain in place every year the individual owns a homesteaded house in Florida.

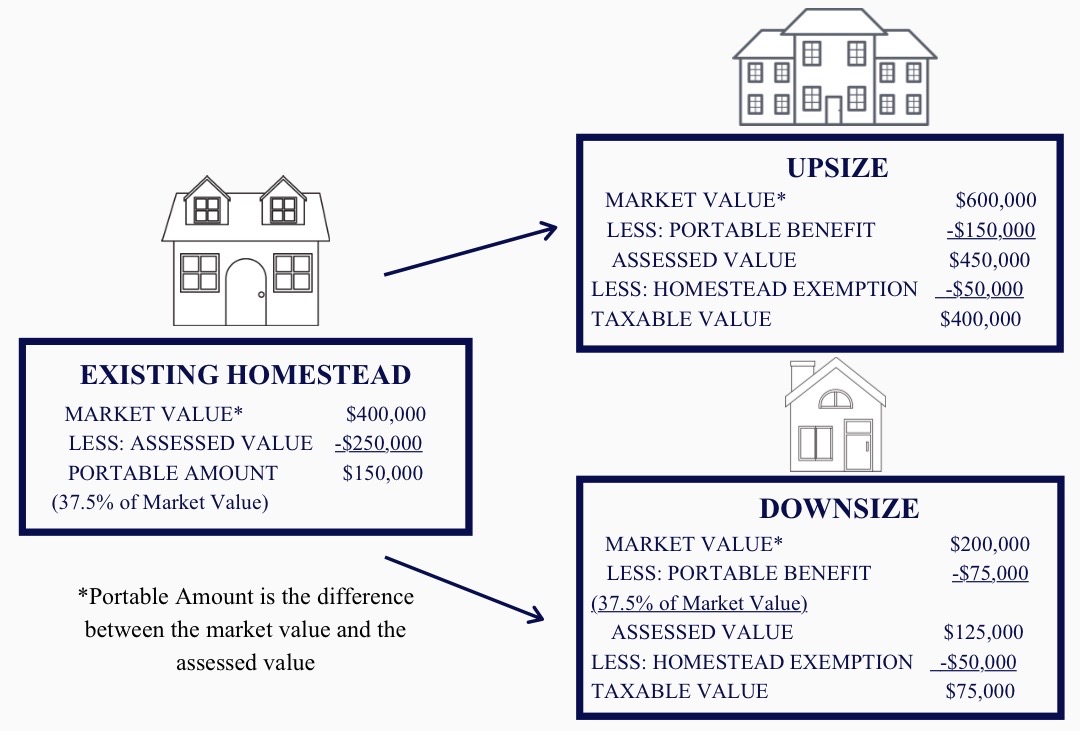

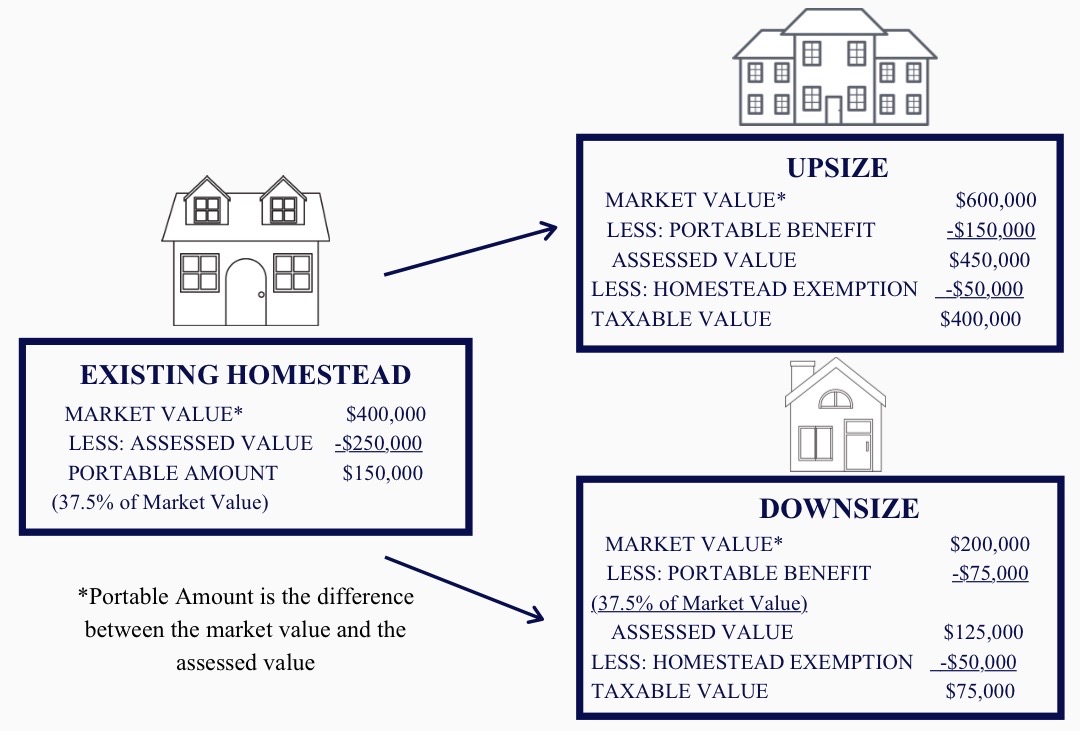

Floridas Save Our Homes SOH provision allows you to transfer all or a significant portion of your tax benefit up to 500000 from a Florida home with a homestead exemption to a new. If you are eligible portability allows most Florida homestead owners to transfer their SOH benefit from their old homestead to a new homestead lowering the tax assessment and. The Save Our Homes cap limits increases in the annual assessment of a home to.

For example a home with a justmarket value of 162000 and an assessed value of 104000 due benefits accrued yearly under the Save Our Homes 3 percent cap is eligible. This estimator assumes that the application for the new homestead is made within 2 years of January 1st of the year. Broward County Property Appraisers Office - Contact our office at 9543576830.

Property owners with Homestead Exemption also receive a benefit known as the Save Our Homes cap. Moving within Florida Tax Benefits of Portability. To maximize the homestead.

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. I a small standard. In Florida Property Tax Portability refers to the ability to transfer up to 500000 of accumulated Save Our Homes Cap Savings from an existing or prior homestead exempt.

Proportion of cap of previous homestead to just value 100000 400000 25 percent which is applied to new homesteads just value 25 percent x 250000 62500 which is then adjusted for proportion. The State of Florida has a few property tax exemptions including a homestead exemption. Application to port from a prior homestead to be turned in when you file for a new homestead exemption.

Each county sets its. Calculated cap 31250. Calculated assessed value 218750.

Please contact our accessibility hotline for. A new Florida law allows residents that are moving from one primary residence to another to bring the built-up property. On the Real Estate Tax Bill or use the parcel record search.

Property taxes apply to both homes and businesses. With portability they can take the savings with them up to a maximum of 500000. EPGD Business Law is located in beautiful Coral.

What Do Realtors Need To Know About The Homestead Laws Florida Homestead Check

Property Tax Portability Jennifer Sego Llc

Understanding Florida S Homestead Exemption Laws Florida Realtors

Estate Planning With Portability In Mind Part Ii The Florida Bar

Florida Homestead Check For Homeowners

Must Know Facts About Florida Homestead Exemptions Lakeland Real Estate

Homestead Portability What Is It And Should I Apply For It Us Patriot Title

What Is Florida Homestead Portability Epgd Business Law

Florida Homestead Check For Homeowners

What Do Realtors Need To Know About The Homestead Laws Florida Homestead Check

Property Tax Portability Jennifer Sego Llc

/arc-anglerfish-arc2-prod-tbt.s3.amazonaws.com/public/R76EFPWHBMI6TBKNIBWI6S7HAY.jpg)

Portability Benefit Can Reduce Tax Burden For Property Owners Moving Into Larger Or Smaller Homes

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

The Big Three Grandfathered Homesteads Portability Westchase Fl Patch

Estate Planning With Portability In Mind Part Ii The Florida Bar

Real Estate License Reciprocity Portability Guide

Florida Homestead Check Home Facebook

What Do Realtors Need To Know About The Homestead Laws Florida Homestead Check